Special Edition: BIO DIGITAL 2021

Italy sees hike in biotech R&D investments, at rate higher than EU average

The strong and dynamic synergies between universities, research centers, startups and large companies make the country a good location for biopharma investment, maintains the Italian Trade Agency (ITA) and other official entities.

They cited a report by consultants, The European House – Ambrosetti, showing that between 2013 and 2019, pharma R&D investments in Italy increased by 31%, higher than the European average of 24%, and reaching a value of €1.6bn (US$1.94bn).

According to Assobiotec report, BioInItaly 2020, some 49% of the over 700 biotech companies based in Italy are involved in healthcare.

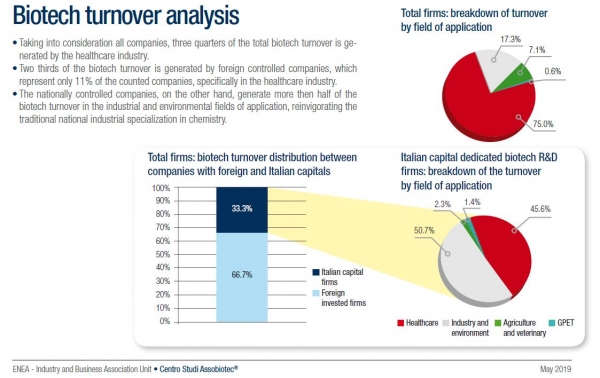

Two thirds of the biotech turnover is being generated by foreign holdings, with those companies, mainly active in healthcare, accounting for only 11% of the sector, found that review. Over 50 new startups, active in the biotech field, were registered between 2017 and 2019, it added.

The current therapeutic pipeline counts 375 biotech projects, with a solid specialization in the fields of oncology, infectious diseases, and neuroscience.

Rare disease and advanced therapy medicinal products (ATMPs) are among areas of excellence of Italian biotechnology research, and some 80% of Italy’s biotechnology companies are micro or small-sized organizations, reads the report.

That publication also referenced a Eurostat study showing that, with the high number of active PhD programs in science and technology, Italy ranks second among European countries in terms of the training of personnel dedicated to R&D.

Tech transfer investments

There has been investment made to support tech transfer, the process of conveying results stemming from scientific and technological research to the marketplace and, therefore to society, noted Assobiotec.

According to data from The European House – Ambrosetti, Italy has a network of Technology Transfer Offices (TTOs) that are dedicated to life science. In total there are 99 TTOs in the country, 54 of which belong to universities, 23 to scientific research hospitals, 3 to national public research Institutes.

The Assobiotec publication highlighted, though, that despite the commitment and dedication by the national TTOs, they are lacking in resources and personnel when compared to other markets.

“For every unit there is an average of 4.2 active people in charge of the knowledge transfer while abroad, in similar units, there are 8.5 active people.

“It is for this reason that Italy, realizing the need to fill this gap, has finally decided to undertake some important steps towards the innovation policy, investing in order to strengthen the technology transfer activities and promoting the relationship between research and markets.

“Specifically, several calls and initiatives have been launched in order to facilitate meetings between researchers and companies and bring research developments a stage closer to industrial application.”

COVID-19 linked innovation, funding

The Assobiotec report also noted that Italian biotech companies are at the forefront in the battle against coronavirus Sars-CoV-2.

Indeed last month saw Italy's government revive hopes that Italy would produce the country's own COVID-19 vaccine, On May 21, it said it was ready to finance the ReiThera project despite a court ruling rejecting a plan to pump public funds into the Rome based biotech company, reported Reuters.

ReiThera's vaccine, which is based on the same technology as that used in the Oxford-AstraZeneca and Johnson & Johnson vaccines, has concluded Phase II trials; however, the project needs public funding to start Phase III trials.

Italy's state audit court said of the €50m (US$60.96m) of public money directly pledged for ReiThera, too little was dedicated to the research and production of the vaccine and too much to a general strengthening of the company, including the purchase of its headquarters.

But Italy’s minister for industry, Giancarlo Giorgetti, said in a statement on May 21, after the court ruling, that his ministry is ready to contribute to the ReiThera vaccine project “in the forms and ways allowed, using different and innovative tools... provided by the new rules."

Italy said it would introduce tax breaks of 20% for companies conducting R&D for innovative drugs, including COVID-19 vaccines, provided they grant non-exclusive licenses, according to a draft decree seen by Reuters.

Italian researchers are also close to developing an oral COVID-19 vaccine.

April saw NextBiomics, a biotech company involved in the research and development of Next Generation Probiotics and a spin-off of the Federico II University of Naples, and Sequentia Biotech, a Spanish omics company, announce the filing of a patent application for a Covid-19 bacterial vaccine that is administered orally.

The vaccine does not need to be injected, nor does it use a viral vector such as Adenovirus, but rather relies on the intrinsic ability of Escherichia Coli Nissle 1917, a bacterium of the genus Escherichia isolated by German researcher Alfred Nissle in 1917.

Data from the preclinical phase conducted on mice shows that the administration of the oral vaccine for five days a week for a period of 17 weeks was able to significantly stimulate the immune response by producing the IgM and IgG antibodies, without any side effects, said Giuseppe Esposito, professor of pharmacology at La Sapienza University (Rome), and cofounder of Nextbiomics, told Italian news agency, ANSA.