Jefferies Healthcare Conference: How CDMOs are embracing the obesity drugs craze

With sales of branded anti-obesity drugs expected to hit $44 billion in 2030, the drugs have been a key topic of conversation at this week’s Jefferies London Healthcare Conference.

During a panel focused on the CDMO post-covid landscape, David Windley, managing director of Jefferies Equity Research, quipped that ‘every room needs a GLP-1 question’ and said 60 to 70% of his discussions with investors had been about the medications.

After posing the question of just how impactful GLP-1s could be for the industry, each panellist was optimistic about the potential of the drugs, with Sylke Hassel, CEO of Axplora, even comparing the scale and demand to the Covid-19 pandemic.

“I think the GLP-1 need is probably similar to the Covid-19 pandemic. This is the time for us as an industry to step up and show what we can do about it. We must show what we can deliver in terms of science, speed, reliability of supply and security of supply,” she said.

“This could change the industry and I think it could also change how the CDMO is perceived. Covid was an initial step but I believe that is going to continue as we can add many valuable inputs, from value of delivery to implementation and patient need.”

Thomas Meier, CEO of Bachem, concurred that GLP-1’s have been ‘very’ impactful on the industry – as they are attracting so much attention and consuming a lot of capacity.

“The numbers are so large and as the CDMO industry – we want to get it right. We want to show that we’re delivering value to our customers and that there is a better way than doing everything in-house – that we can be trusted, we have the right quality, speed and produce at good cost,” he said.

“Now is the time to show customers and society more generally, what kind of value we can bring to the equation. We're working on it diligently within our company and I think in the entire ecosystem, we see the opportunity and we will work together to make it happen.”

After the pandemic, this new market is also an opportunity for the CDMO sector to demonstrate that it can scale these products in a way that pharma companies would not be able to do independently, Bas van Buijtenen, CEO of LTS Lohmann, added.

“It’s a blessing in terms of timing, because the reality was that some parts of the sector, after the wave of Covid-19, were perhaps not quite as busy – and this has allowed the sector to jump in very quickly with the early demand,” he said.

“At the same time, there is aggressive investment behind it and many elements must come together to make it work. The industry is very well positioned to execute operations in a more nimble way, than perhaps some of the customers could do if they tried to do it alone.

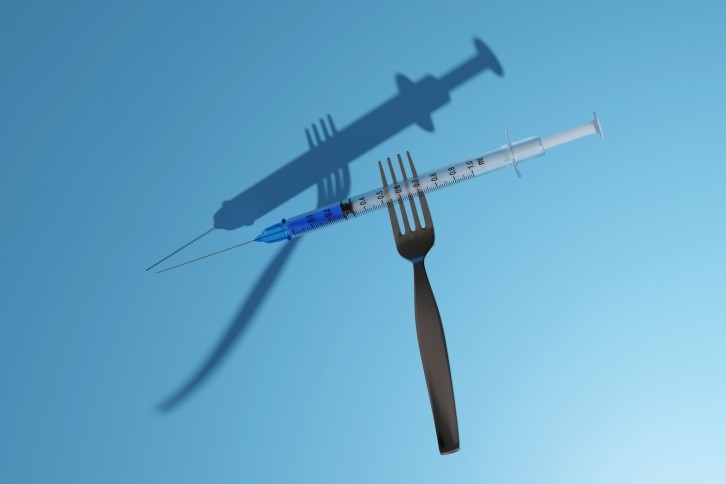

“The way it’s being administered today, there are still imperfections. So it's also an opportunity for the innovative potential of the suppliers to optimize and improve upon the way that it’s being delivered today.”

From Novo Nordisk’s Ozempic and Wegovy to Eli Lilly’s Mounjaro, the market is poised for further growth and CDMOs are actively anticipating demand and getting ahead of the curve.