Bioavailability to drive drug delivery deals in 2013 says analyst

CEO of Current Partnering, Steve Poile, has offered In-Pharmatechnologist.com his professional insight into what 2013 will hold for drug delivery, following data released in Current Partnering’s Drug Delivery Partnering Yearbook 2013.

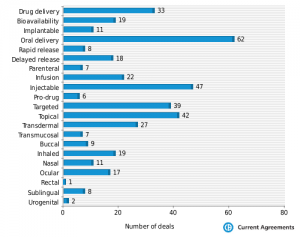

The yearbook provides access to the delivery technology-related deals and agreements made by the leading healthcare companies in the past year. All charts below have been reproduced from Current Partnering’s Drug Delivery Partnering Yearbook 2013.

How would you describe the 2012 trend in drug delivery deals and what is your outlook for the coming year?

During 2012, we saw a decline in the overall number of partnering deals announced since the height in 2010, however there has been a recovery of sorts from the lows of 2011.

In general, across all sectors we have seen a general decline in the number of deals being announced, due in great part to the lower appetite for dealmaking in the current economic climate. However, we expect the trend to be upwards during 2013 as larger companies seek to refill pipelines with new candidates, and this includes the drug delivery sector.

Could you explain your findings regarding type of drug delivery technology and the deals made in 2012?

The findings are consistent with recent years with a lot of emphasis on altered oral delivery profile to provide patient compliance being the mainstay of delivery deals. Injectable technology (this includes needle free) deals continue to be prevalent and will continue to be so until compelling alternatives to the delivery of biologicals are available.

Alternative routes of administration such as nasal, buccal, sublingual and so on, are growing in popularity and continue to promise a lot, however bioavailability and reproducible dosing will keep being an issue in the foreseeable future.

Was there any difference in the therapy focus of drug delivery deals?

These closely mirror the therapy areas which gain the most attention in dealmaking overall. First in popularity is oncology followed by infectives, and CNS. There are no particular deviations away from this trend, suggesting that drug delivery dealmaking does not specialise in a particular therapy area different to that found in dealmaking overall.

How would you describe the above chart and what conclusions can you make regarding the stage of development when deals are announced?

Not surprisingly, the majority of drug delivery dealmaking takes place when initial product is launched and franchise extensions or specialty products are considered in order to extend and protect products market position. This is increasingly the case when specialty pharma seeks to develop branded generics with patient compliance enhancements when patents expire.

There is however a growing trend for preclinical stage drug delivery deals where the prospect of incorporating a new entity in a delivery vehicle is considered at the outset of clinical development. This is increasingly the case where biolgocals are concerned.

Finally, what direction will drug delivery deals follow in 2013?

We expect to see more drug delivery deals in 2013 with emphasis on biologicals delivery at preclinical development stage, and the continued use of drug delivery as a differentiating factor in the specialty market.